Featured

Table of Contents

The catch is that not-for-profit Debt Card Financial debt Mercy isn't for every person. InCharge Debt Solutions is one of them.

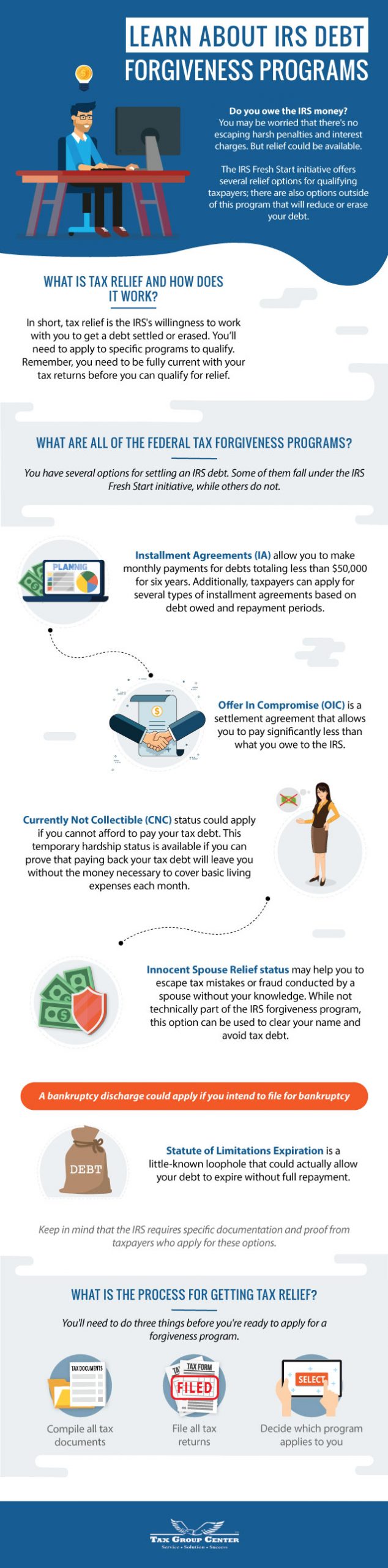

The Credit Report Card Forgiveness Program is for individuals who are so much behind on debt card repayments that they are in major economic difficulty, perhaps dealing with insolvency, and don't have the earnings to capture up."The program is specifically made to assist customers whose accounts have been billed off," Mostafa Imakhchachen, customer treatment specialist at InCharge Financial debt Solutions, claimed.

Lenders that participate have actually agreed with the nonprofit credit counseling agency to accept 50%-60% of what is owed in repaired month-to-month settlements over 36 months. The set repayments suggest you understand precisely how much you'll pay over the settlement period. No rate of interest is charged on the balances throughout the reward period, so the payments and amount owed do not transform.

It does reveal you're taking an active role in reducing your financial debt., your credit rating score was already taking a hit.

The Best Guide To Permanent Impact on Personal Credit Score

The therapist will assess your funds with you to establish if the program is the right alternative. The review will include a consider your regular monthly revenue and expenditures. The company will certainly draw a credit rating record to understand what you owe and the extent of your hardship. If the mercy program is the most effective service, the therapist will send you a contract that details the strategy, including the amount of the month-to-month payment.

Once every person agrees, you begin making monthly payments on a 36-month plan. When it mores than, the agreed-to quantity is eliminated. There's no charge for paying off the balance early, however no extensions are allowed. If you miss a payment, the agreement is nullified, and you have to leave the program. If you think it's a great option for you, call a therapist at a not-for-profit debt therapy company like InCharge Financial obligation Solutions, who can address your inquiries and assist you identify if you qualify.

Because the program allows customers to work out for less than what they owe, the financial institutions who take part want confidence that those that benefit from it would certainly not have the ability to pay the sum total. Your credit card accounts additionally should be from financial institutions and credit score card firms that have actually agreed to get involved.

The 6-Minute Rule for The Value of Certified Bankruptcy Counselors

If you miss a payment that's simply one missed out on repayment the agreement is terminated. Your creditor(s) will certainly terminate the strategy and your balance goes back to the original amount, minus what you've paid while in the program.

With the forgiveness program, the lender can instead pick to keep your financial obligation on the publications and recoup 50%-60% of what they are owed. Nonprofit Charge Card Debt Forgiveness and for-profit financial debt settlement are comparable in that they both give a way to work out charge card financial debt by paying less than what is owed.

Credit score card mercy is made to set you back the customer less, repay the financial debt quicker, and have less drawbacks than its for-profit equivalent. Some key locations of difference between Credit report Card Debt Mercy and for-profit financial obligation negotiation are: Credit score Card Financial debt Mercy programs have connections with creditors that have accepted take part.

The Greatest Guide To Documents to Prepare When Pursuing Bankruptcy Counseling

Once they do, the payback period begins quickly. For-profit financial debt settlement programs bargain with each lender, normally over a 2-3-year duration, while passion, fees and calls from debt collection agencies proceed. This means a larger appeal your credit rating record and credit report, and an enhancing equilibrium until settlement is finished.

Debt Card Debt Mercy clients make 36 equal regular monthly repayments to eliminate their debt. For-profit financial debt negotiation clients pay right into an escrow account over a settlement duration towards a lump amount that will be paid to financial institutions.

Table of Contents

Latest Posts

Some Known Factual Statements About Expert Guidance Preserves Your Assets

Rumored Buzz on Ongoing Support and Follow-Up Programs

The Only Guide to Ways Is It Legal to Get Out of Debt Without Paying? Here's the Truth : APFSC Guarantees Regulatory Compliance

More

Latest Posts

Some Known Factual Statements About Expert Guidance Preserves Your Assets

Rumored Buzz on Ongoing Support and Follow-Up Programs

The Only Guide to Ways Is It Legal to Get Out of Debt Without Paying? Here's the Truth : APFSC Guarantees Regulatory Compliance